神道は日本に昔からある宗教で、その始まりは縄文時代とも言われています。仏教が日本に伝来して広く普及した後も、神道が日本人の歴史や文化に深く根付いているのは間違いありません。

お葬式は仏教式で行うことが多くても、神社に初詣にお参りに行くという人も多いのではないでしょうか。お宮参りや七五三など子どもの健やかな成長を願う儀式なども行われています。そんな神道は、仏教やキリスト教とは違った死生観があります。

亡くなると神になる神道

神道では神羅万象に神が宿るとされており、あらゆる事象に神が存在します。八百万の神々という言葉もあるように、自然の物には全て神が宿っていると考えられているのです。

山などの自然も信仰の対象ですし、災いを神格化することもあります。権力を持っていた人物や恨みを残して亡くなった人を神として崇め、祟りを受けないようにした事例も多いようです。

神道での死生観もそれに通じるものがあり、人は亡くなると子どもや孫など家庭を守る神のような存在になります。神道は地縁や血縁で繋がっている共同体を守る目的で信仰されてきました。

祖先を神格化し、祖霊を祀るのが神道の考え方になります。キリスト教の聖書のような教えはなく、神道の教え等は神社や氏子たちの祭りに受け継がれています。それに対して仏教は、人の魂を救済したり国家の安定を目的に信仰されてきたのです。仏教の死生観は輪廻転生に基づいていて、人は亡くなると別の世界に生まれ変わります。

災いや穢れを払う儀式が葬儀

神道では魂が非常に重要で、肉体はただの入れ物と考えられています。そのため肉体が滅んだ「死」は、決して悲しいものではありません。肉体の死は災いや穢れと考えられるので、葬儀は神の力で穢れを払う儀式になります。

仏教でも人は亡くなると仏という存在になりますが、仏教が発祥したインドでは仏というと仏陀のことをさしています。修行をして悟りを開いた覚者のことをサンスクリット語でブッダといい、それが仏陀となって仏となりました。それが日本に伝来すると、仏は全ての死者を表す言葉となったのです。これは仏教というよりは、神道の影響を大きく受けています。神道の死生観が、日本に根付いている証拠といえるでしょう。

ちなみにキリスト教では人は亡くなると神の審判を受けるために、一度だけ肉体が復活します。土葬となるのが主流で、火葬は行われません。肉体がただの入れ物と考える神道とは、そういった点が大きく異なります。

穢れに神様が触れないように神社では行わない

神道での葬儀は、故人の魂をその家の守護神にするための儀式でもあります。近年、葬儀を行う場所は葬祭場などの施設にすることが多いです。遺族や参列する人の負担が少ないため、施設を選ぶ人が多くなっています。しかし、仏教ではお寺で葬儀を行うのが本来の形でした。神道では人の死そのものが穢れと考えられているので、神様がいる場所である神社で葬儀を行うことはありません。必ず自宅や葬祭場などで行います。

「穢れ」といっても、それが悪いというわけではありません。穢れの語源は「気枯れ」にあり、気力を失った状態であることを指しています。生命力が衰えている時期なので、神様に近づけると良くないとして避けるのです。

家の中に神棚がある場合には、そこにいる神様に穢れが触れないように神封じを行います。葬儀の前に通夜祭を行いますが、住んでいる地域によっても行う儀式は異なっています。住んでいる地域の風習に則って行う必要があります。

神様に玉串を奉納する

神道の葬儀では、玉串台を設置して祭壇と棺も安置します。神道の場合には正確に言うと、葬儀ではなく葬場祭となります。拍手をする場合には、忍手という方法で音を立てずに行うのが葬場祭のマナーです。それから玉串奉奠の儀を行います。

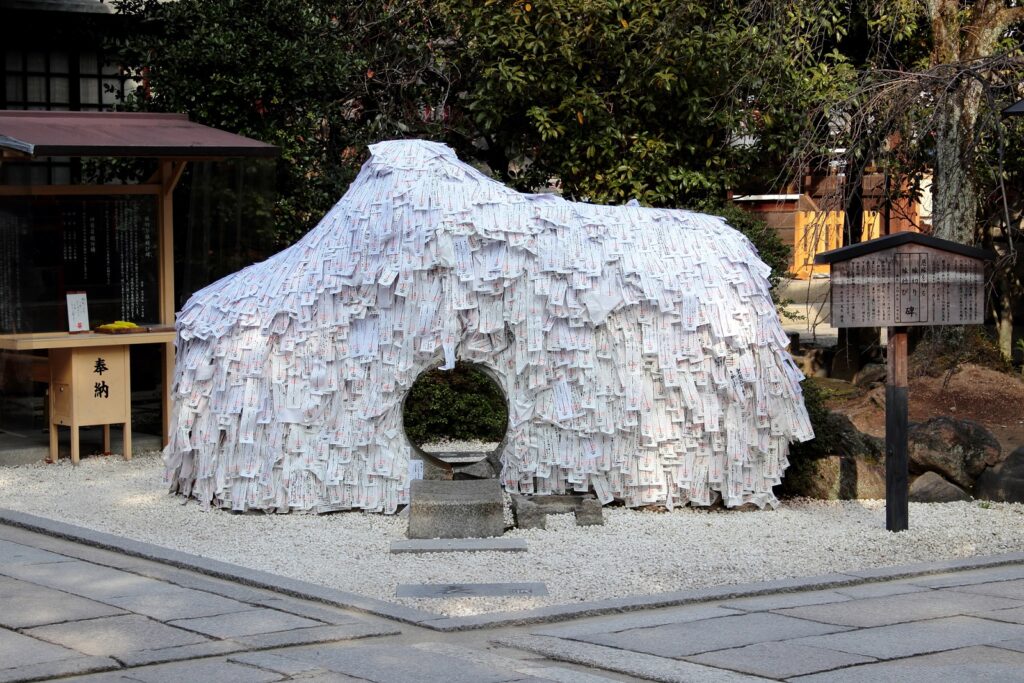

これは仏教式だと焼香に当たる儀式になります。玉串は神様が宿るとされる榊の枝に紙垂を結んだもので、それを神様に捧げる儀式です。玉串奉奠の義は、葬儀だけではなく結婚式の神前式などでも行われます。七五三やお宮参りなど神社で行われる儀式に用いられます。その後は火葬場に移動して火葬祭を行い、火葬場から帰ってきた人に対してお清めをする儀式も行います。

葬場祭に参加する際に気を付けたいことには、数珠を使わないことが挙げられます。数珠は仏教式で使用するものなので、持って行かないようにしましょう。また、供養や冥福といった言葉は使用しないので、参列する際には気を付ける必要があります。

仏教とは異なり、

「神道ではご冥福をお祈りします。」という言葉がつかえないのです。

冥福とは故人の死後の幸福を祈る意味であり、遺族に使う言葉ではありません。そして、死者の死後の幸福を祈る必要のない一部宗教においては、使わない言葉であります。

▼神道のお悔やみの例文(口語)

「この度は御愁傷様でした。謹んでお悔やみ申し上げます」

「この度は思いがけない事でとても残念です。どうかお力落としなさいませんように」

参考:「ご冥福をお祈りします」は故人に対して死後の幸せを祈る言葉|正しい使い方と使ってはいけないタイミングとは|葬儀のデスク

神道の死生観では、人は亡くなると家庭を守る守護神となります。肉体は元々魂の入れ物なので、肉体が滅んでも悲しいわけではありません。ただし、神道では人の死を穢れや災いと考え、それを祓う儀式が葬儀になります。神様に穢れが触れないように葬儀は神社では行わないのが一般的です。また、故人の魂を守護神にするための儀式でもあり、神様に玉串を奉納する儀式も行われます。玉串奉奠の儀と呼ばれるもので結婚式や七五三などでも行います。